Robert D Reed Publishers

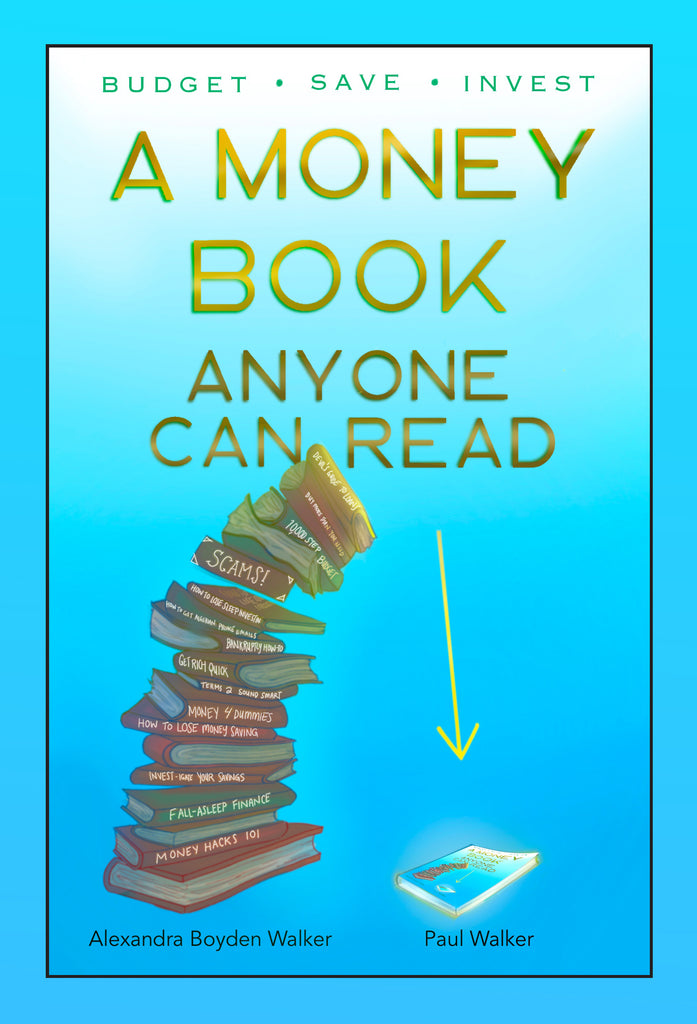

A MONEY BOOK ANYONE CAN READ

A MONEY BOOK ANYONE CAN READ

by Alexandra Boyden Walker and Paul Walker

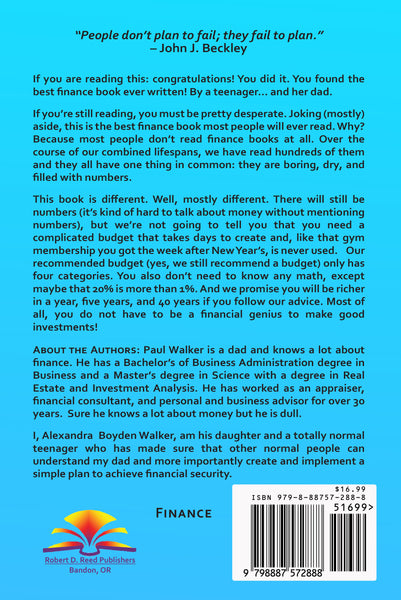

“People don’t plan to fail; they fail to plan.”

~ John L. Beckley

AS ALEXANDRA DESCRIBES THIS BOOK:

Full transparency: this book was written by a teenager and her dad.

Now if you’re reading a finance book written by a teenager you must be pretty desperate. All kidding aside, this is the best finance book most people will ever read. Why? Because most people don’t read finance books. And her dad has read hundreds, and they all have one thing in common. They are boring, dry, and filled with numbers.

This book is different. Sure we use a few numbers because it’s kind of hard to talk about money without mentioning, well, numbers. That said, you don’t need a complicated budget that takes days to create. You also don’t need to know any math. Well, you might need to know 20% is more than 1% (which is probably more than what most financial advisors realize). And the authors promise you will be richer if you follow their advice. More importantly, you do not have to be a financial genius to make good investments.

On one hand, this is a beginner’s guide to managing money. On the other hand, it is the only guide you will ever need. The fact is that managing money is not that complex, and the basic principles have not changed since the beginning of time.

Managing your money is really a four-step process.

- First, you need to save money so you have something to invest.

- Second, you need to invest your money. The investments you select are based on how you view risk, how much time you have before you plan to spend the money, and a few other variables.

- Third, you need to protect your assets, which includes your body as well as your worldly possessions, and it is called insurance.

- And finally, you need to have a general understanding of economics, taxes, and risk so that you can make informed decisions over time. While finance has not changed over time, we want our investments to withstand the economic ups and downs.

Finally, because our mom is a teacher, at the end of each chapter, you will find homework. Okay, technically not homework but a place to keep notes on your spending, goals, savings, etc.

If you are reading this: congratulations! You did it. You found the best finance book ever written (by us). Don’t believe us? Read the reviews:

“Hate reading? Love money? This is the book for you.”

~ Alexandra Boyden Walker, Author

(unless you plan on suing) of this book

“If my dad can manage and invest money, it can’t be that hard because he can’t even figure out how to use the remote.”

~ Calvin Boyden Walker,

brother of the illustrious Alexandra Boyden Walker

Oh, one last thing: occasionally, Dad will go off

on a tangent that we found either too helpful or entertaining to cut: thus, there will be the warning, “Incoming Dad Rant” when one is about to appear.

The Authors Introduce Themselves:

Paul Walker. I have two business degrees and have worked as an appraiser, financial consultant, personal and business advisor, and business owner. Over the years, I discovered that many people make financial blunders and go broke saving money. They refinance their homes and never pay them off or think they are saving money with lower car payments but longer loans. At the same time, I discovered many people who became extremely wealthy by simply making conscious decisions about how to spend their money, spending less than they earned, and investing their savings. I wrote this book because I wanted a book for my kids that would provide a roadmap for a secure financial future. It turns out that most people are perfectly capable of managing their finances once they have the tools and confidence to do so. pauljwalkerconsulting@gmail.com

Alexandra Boyden Walker. I am a totally normal teenager preoccupied with typical teen angst like navigating school, crushes, and the best investment strategy to insure I don’t outlive my savings when I retire in a few years. I am also pretty good at translating my dad’s boring lectures and incoherent advice into a book you might actually like reading. In my spare time, I also enjoy writing fiction: my current projects are a cartoon/novel/screenplay/television show (we’ll figure out what medium it is after I’ve finished writing it) and college essays (that’s a joke for any prospective college admissions officers reading this). I also enjoy art, reading, rolling my eyes at my dad, and mindlessly scrolling on the internet. www.mindfulcynic.com

NOTE FROM THE PUBLISHER:

THIS IS A BOOK THAT SHOULD BE A TEXT IN HIGH SCHOOLS AND COLLEGES EVERYWHERE TO GIVE STUDENTS A HEAD START IN MONEY MANAGEMENT, ETC!! BULK DISCOUNTS ARE AVAILABLE BY CONTACTING THE PUBLISHER DIRECTLY! (Write to cleonelreed@gmail.com.) HERE IS WHY:

- Written by a financial advisor and his teenage daughter, the book is both comprehensive and easy to understand.

- Explains how to manage your money without spending hundreds of hours on a budget you will never use or waste your time searching for a get-rich-quick scheme.

- Instead of micro-managing your finances, the authors recommend aligning your spending and savings with your values and automatically saving money.

- Teaches you how to save hundreds of millions of dollars on groceries. Ok maybe not that much, but it will... It shows you how the phrases “sale” and “lower monthly payments” are deceptively used to convince you to spend more money.

- Explains how to pick investments while explaining important terminologies like your risk tolerance and timeline.

- The book provides the knowledge and resources you need to insure that you can invest with confidence.

- Provides the information you need so that you actually understand what expenses your insurance policy actually covers, how to get a mortgage, and what is included in a will and trust.

- Provides a guide to managing your investments over time as compared to reacting to bad financial news or hot investment tips.

- Helps you reach your financial goals.

- The book includes a number of worksheets to help manage your money and monitor your savings.

Paperback: 268 pages, $16.99, Available here or on Amazon

Kindle version: $8.99, also available on Amazon

Soft Cover ISBN: 979-8-88757-288-8

eBook ISBN: 979-8-88757-275-8